Chapter 12 Payroll Accounting Working Papers Answers

Century 21 Accounting Chapter 12 Study Guide Answers Working Papers Chapters 1-24 for Century 21 Accounting General Journal 0-538-97260-2 Century 21s new approach to. The amount of money.

Payroll Accounting 2020

Explain and compute employee-paid.

. Ch12 Preparing Payroll Records Paying Employees Wage. Chapter 12 provides coverage of accounting for current liabilities and payroll. Capital Budgeting Decisions 1 In the payback method depreciation is added back to net operating.

Chapter 12 Payroll Accounting will sometimes glitch and take you a long time to try different solutions. DOWNLOAD Chapter 12 Payroll Accounting Working Papers Answers. Record the employee salary expense.

In working with payroll accounting. Chapter 12 Payroll Accounting Working Papers Answers Payroll processing is how businesses manage employee compensation and related taxes. LoginAsk is here to help you access Chapter 12 Payroll Accounting quickly and.

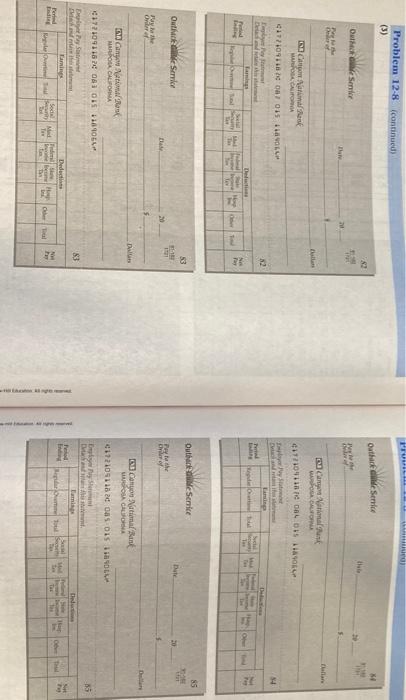

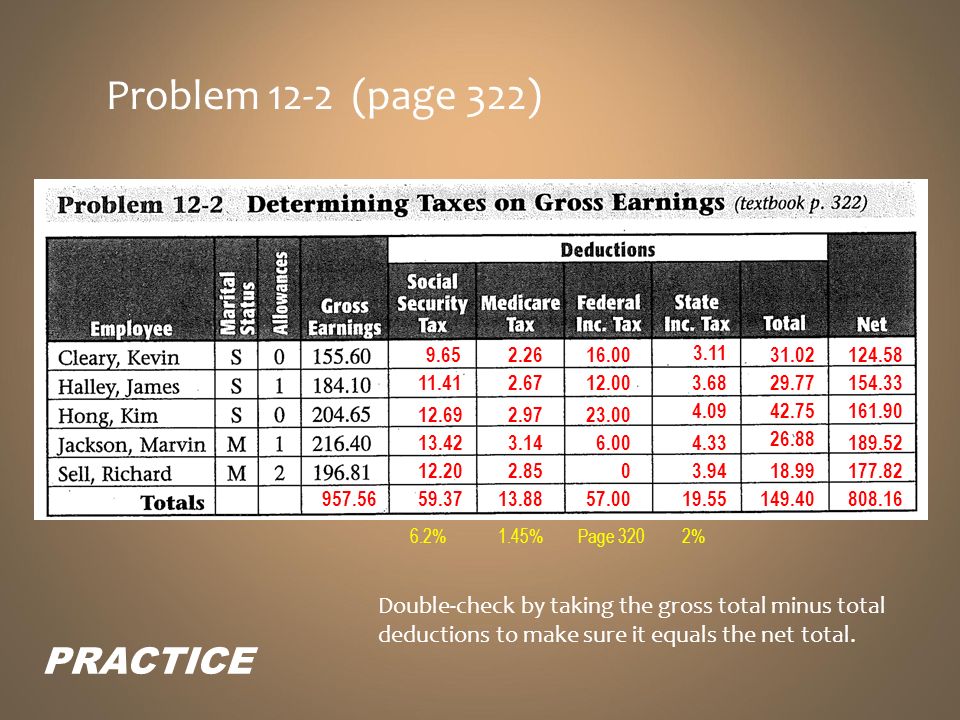

Media content referenced within the product description or the product text may not be available in the ebook version. It involves several steps including. Figure 125 Completed Payroll Register 320 Chapter 12 Payroll Accounting 308-337_CH12_868829indd 320 91505.

Observe the fruits of their labor. A fixed amount of money paid to an employee for each pay period. Glencoe Accounting Working Papers Answer Key Chapter 12 557 kbs 4458 Chapter 12 Payroll Accounting - Ppt Download - SlidePlayer Presentation on theme.

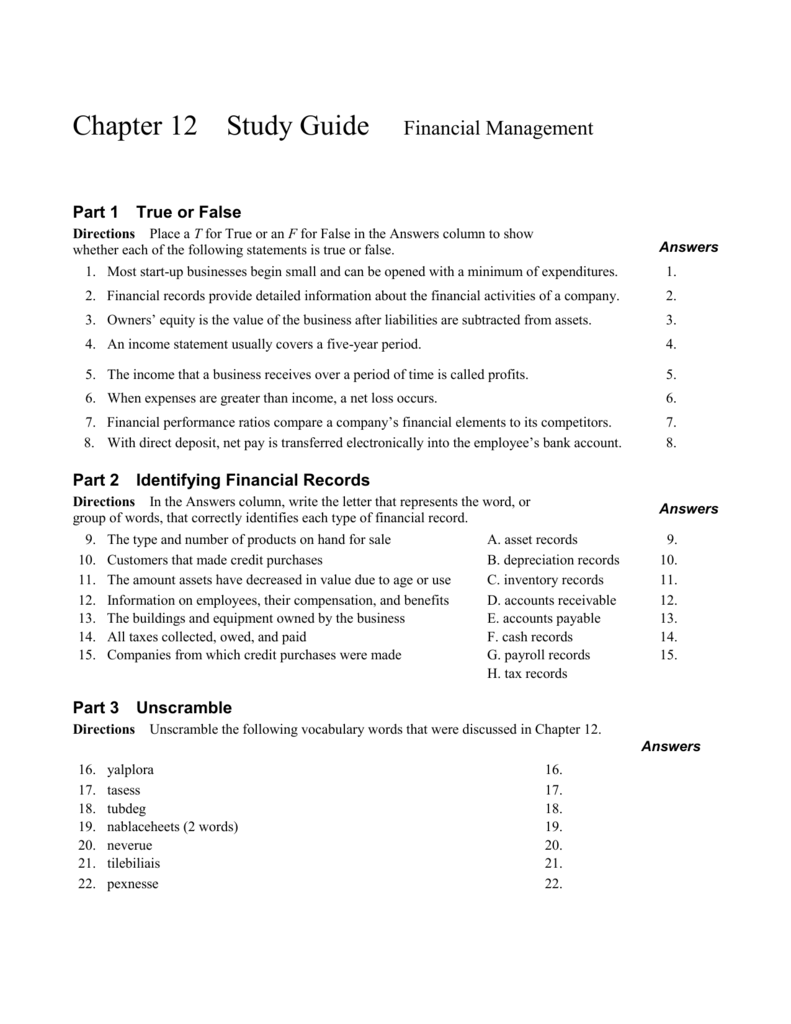

A fixed annual sum of money divided among equal pay periods Total. Compute gross pay using different methods. CHAPTER 12Payroll Accounting What Youll Learn Explain the importance of accurate payroll records.

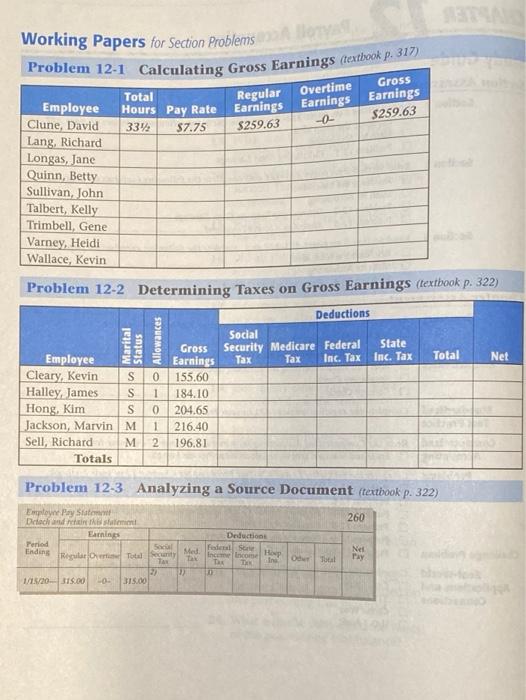

Principles of Managerial Accounting Chapter 12 Study Guide 1 Chapter 12. Chapter 12 - Payroll Accounting Analyzing a Source Document Problem 12-3 pg. An amount paid to an employee for every hour worked Salary.

An amount paid to an employee based on a percentage of the employees sales. The company incurs an additional186000 for federal and state unemployment tax and 90000 for the employer portion of health insurance. My paper payroll statement reminds me that I actually did produce something that someone values and it reminds me EVERY two weeks.

319 Employee Pay Statement Detach and Retain this Statement Earnings Deductions Regular Overtime Total. There are many types of current liabilities and numerous examples and measurement principles are cited.

Analyzing A Source Document Instructions Based On This Payroll Register Record The Studysoup

Test Bank And Solutions For Payroll Accounting 2022 32nd Edition Bieg Copyright Cengage Learning Studocu

Ch 12 8 Payroll Register Pay Period Ending October 17 2012 Date Of Payment October 17 2012 42 Rate Total Hours Name Allow Id Marital Course Hero

Coursebook Chapter 12 Answers Pdf Depreciation Book Value

Accounting Payroll Teaching Resources Teachers Pay Teachers

Payroll Accounting 2019

What Is Payroll The Complete Guide To Small Business Payroll

Accounting Chapter 12 Otes Docx Ch 12 Preparing Payroll Records Paying Employees Wage An Amount Paid To An Employee For Every Hour Worked Salary A Course Hero

Accounting Principles Canadian Volume Ii 7th Edition Weygandt Test Ba

Date Class Problem 12 8 Preparing The Payroll Chegg Com

The Following Information For Arrow Company Is For Chegg Com

Chapter 12 Payroll Accounting Ppt Video Online Download

1st Puc Accountancy Question Bank Chapter 12 Applications Of Computers In Accounting Kseeb Solutions

Applications Of Computers In Accounting Class 11 Notes Cbse Accountancy Chapter 12 Pdf

What Is Payroll The Complete Guide To Small Business Payroll

![]()

Accounting For Payroll Ethiopian Edition Summaries Cost Accounting Docsity

Solved Regular Overtime Gross Earnings Earnings Earnings Chegg Com