33+ Mortgage calculator with 25 years

Private mortgage insurance rates are typically 05 to 10 of the value of the mortgage. Interest can add tens of thousands of dollars to the total cost you repay and in the early years of your loan the majority of your payment will be interest.

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

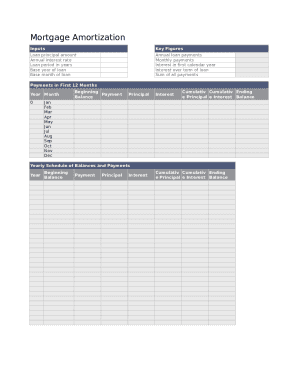

The mortgage early payoff calculator will show you an amortization schedule with the new additional mortgage payment.

. If you choose an amortization period of over 25 years you must make at least 20 down payment. The home loan calculator accounts for mortgage rates loan term down payment more. What mortgage term would you like.

Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. Amortization Period - The actual number of years it will take to repay a mortgage loan in full. Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year.

Build home equity much faster. 7 years 8 years 9 years 10 years 11 years 12 years 13 years 14 years 15 years 16 years 17 years 18 years 19 years 20 years 21 years 22 years 23 years 24 years 25 years 26 years 27 years 28 years 29 years 30 years 31 years 32 years 33. Turn your property into a worthwhile investment.

Dont worry you can edit these later. 91833 Mar 2023 91593 Apr 2023 91352 May 2023 91111 June 2023 90869 July 2023 90626. At the successful completion of your mortgage application LC are paid a commission by the lender and will share a small part of the fee with This is Money.

The calculator lets you determine monthly mortgage payments find out how your monthly yearly or one-time pre-payments influence the loan term and the interest paid over the life of the loan and see complete amortization schedules. Then 524 variable Monthly repayments. Current mortgage rates are averaging 566 for a 30year fixedrate loan 498 for a 15year fixedrate loan and 451 for a 51 adjustablerate mortgage according to Freddie Macs.

The appraisal is done for. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Private mortgage insurance or PMI is a type of insurance typically required by the mortgage lender when the borrowers down payment on a home is less than 20 of the total cost of the home.

Once the fixed-rate period ends usually after five years and. 15-year FRMs also have rates that are lower by 025 to 1 than 30-year FRMs. Mortgage Early Payoff Calculator excel to calculate early mortgage payoff and total interest savings by paying off your mortgage early.

This may go beyond the term of the loan. Usually 15 or 30 years in the U. This mortgage calculator uses the most popular mortgage terms in Canada.

People typically move homes or refinance about every 5 to 7 years. The loan is secured on the borrowers property through a process. Total of 360 Mortgage Payments.

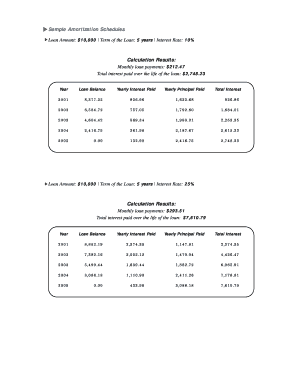

If a person. The following example compares two mortgages with the same loan amount but with different terms. Base 125 for 5 years.

Base 133 for 2. The longest term you will be to apply for is up to your age of retirement. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage.

Our mortgage calculator helps you estimate your monthly mortgage payments. Once your mortgage balance falls beyond a certain amount such as around 50000 its likely not worth remortgaging with a new lender. Base 133 for 2 years.

If your mortgage balance is already small. While both loan types have similar interest rate profiles the 15-year loan typically offers a slightly lower rate to the 30-year loan. Calculate your monthly payments for a particular loan amount and interest rate using this mortgage calculator.

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. Many other variables can influence your monthly mortgage payment including the length of your loan your local property tax rate and whether you have to pay private mortgage insurance. By making additional monthly payments you will be able to repay your loan much more quickly.

Use the popular selections weve included to help speed up your calculation a monthly payment at a 5-year fixed interest rate of 5540 amortized over 25 years. To achieve this after the initial period you must be able to remortgage at the same rate. The purchase of a house.

Appraised Value - An estimate of the value of the property offered as security for a mortgage loan. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. Base 125 for 5 years.

Mortgage Enquiries 0330 433 2927. You wont make enough savings because of the high fees. Assuming you have a 20 down payment 80000 your total mortgage on a 400000 home would be 320000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1437 monthly payment.

After 8 years the fsagovuk redirects will be switched off on 1 Oct 2021 as part of decommissioning. Loan Amount Down Payment Loan Term 1 years 2 years 3 years 4 years 5 years 6 years 7 years 8 years 9 years 10 years 11 years 12 years 13 years 14 years 15 years 16 years 17 years 18 years 19 years 20 years 21 years 22 years 23 years 24 years 25 years 26 years 27 years 28 years 29 years 30 years 31 years 32 years 33 years 34 years 35 years. Free mortgage calculator to find monthly payment total home ownership cost and amortization schedule with options for taxes PMI HOA and early payoff.

Here are some of the advantages of a 15-year mortgage over a 30-year mortgage. The one-year two-year three-year. In return the.

Compare mortgage deals take advantage of our 40 years of experience. For example mortgages often have five-year terms but 25-year amortization periods. Account for interest rates and break down payments in an easy to use amortization schedule.

Mortgage Calculator excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments. The following table presumes your mortgage maintains a 3 APR for the entire 25-year term. Other lenders may no.

A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. Use our free mortgage calculator to estimate your monthly mortgage payments. But since it pays off your mortgage in half the time it incurs much lower interest charges.

33 Free Editable Amortization Schedule Templates In Ms Word Doc Pdffiller

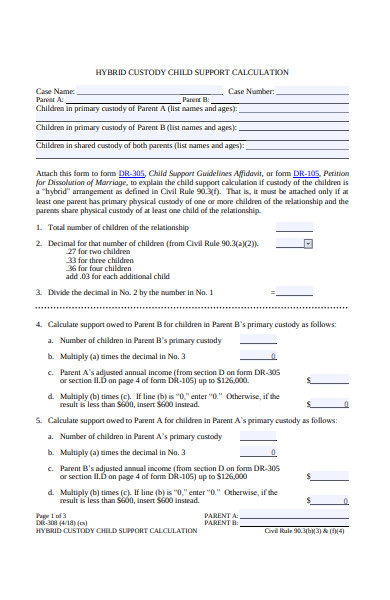

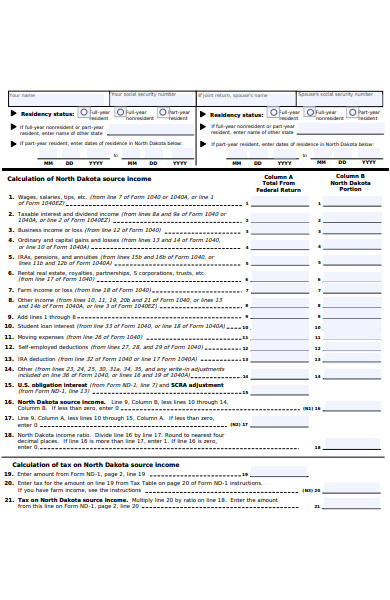

Free 31 Calculation Forms In Pdf Ms Word

911 Sawmill Rd Loveland Co 80537 For Sale Mls 966065 Re Max

Corner Of Avenue M Rd Palmdale Ca 93591 Realtor Com

Composite Deck Pergola Backyard Patio Deck With Pergola Outdoor Patio Space

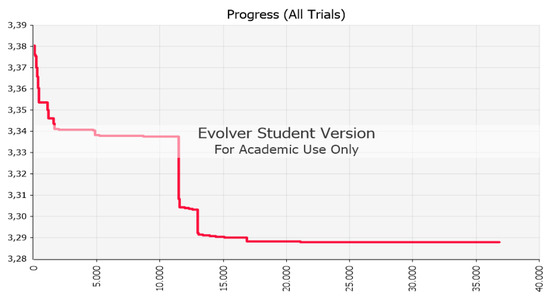

Moose S Software Valley Previous Page Updates Changes

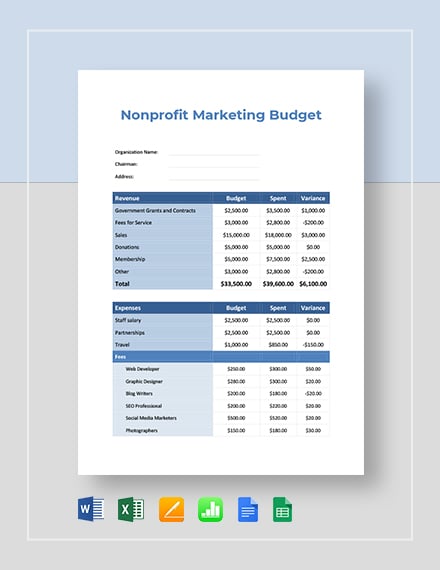

9 Nonprofit Budget Templates Google Docs Google Sheets Ms Excel Ms Word Numbers Pages Editable Pdf Free Premium Templates

The Benefits Of Adding A Deck To Your Home Deck Designs Backyard Patio Deck Designs Patio Design

Half Stone Half Wood Columns And Siding Craftsman Exterior House Exterior House With Porch

Jrfm Free Full Text Optimum Structure Of Corporate Groups Html

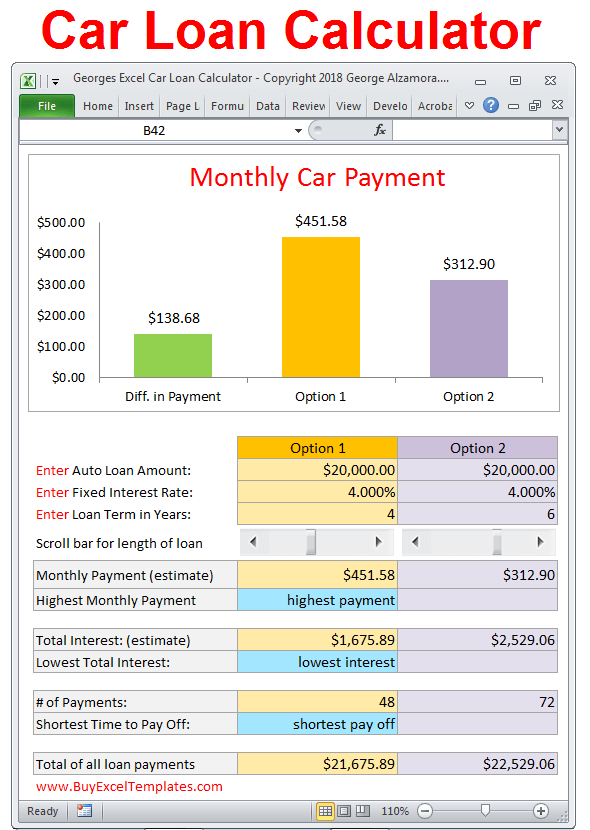

Auto Payment Calculator Top Sellers 53 Off Www Wtashows Com

1

33 Sheet Templates Free Sample Example Format Free Premium Templates

Free Pay Stub Template For Excel 2007 2016 Payroll Template Statement Template Payroll

Free 31 Calculation Forms In Pdf Ms Word

33 Free Editable Amortization Schedule Templates In Ms Word Doc Pdffiller

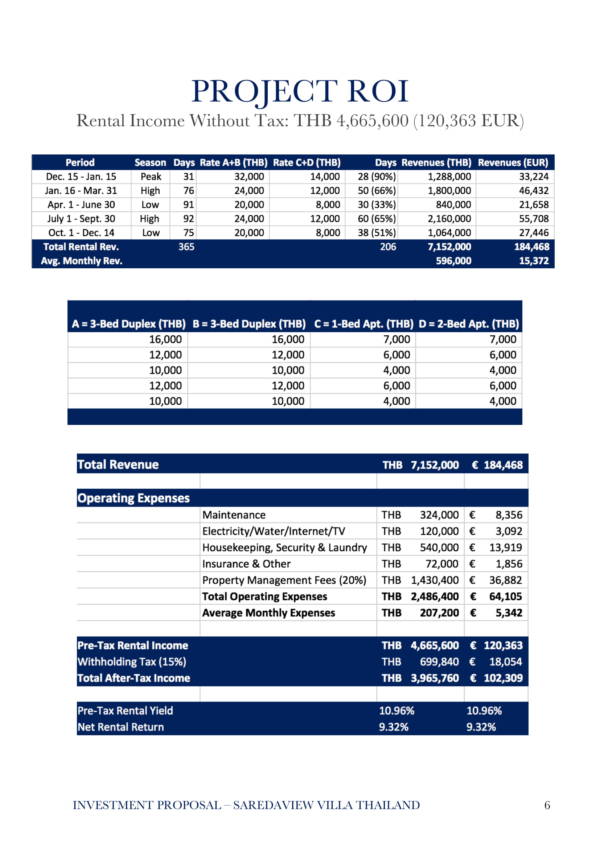

Free 9 Property Investment Proposal Samples And Templates In Pdf Ms Word Pages Google Docs